Blogs

Powering Progress: Navigating Market Shifts and Financial Strategies in the U.S. Energy Industry

Navigating Change in the U.S. Energy Sector The U.S. energy market is undergoing a fundamental shift as renewable energy adoption accelerates, natural gas remains a stabilizing force, and grid modernization becomes a national priority. At the same time, regulatory uncertainty and supply chain risks challenge long-term planning.

The U.S. energy landscape is undergoing a significant transformation, shaped by market forces, policy shifts, and evolving technological advancements. From the rapid adoption of renewable energy to the increasing role of natural gas and regulatory uncertainties, these changes are reshaping the industry’s future. To thrive in this evolving market, energy companies must navigate complex financial and operational challenges.

Chiron Financial LLC is at the forefront of helping energy businesses adapt to these shifts. With deep industry expertise and a commitment to delivering tailored financial solutions, Chiron empowers energy companies to achieve resilience and sustainable growth in a changing market environment.

Key Market Shifts: Impacting the U.S. Energy Industry

Surging Renewable Energy Adoption

The U.S. energy mix is shifting as renewable energy sources, particularly solar and wind, continue to gain ground. In 2024, wind and solar generation surpassed coal, accounting for 24% of total U.S. electricity generation for the first time, marking a milestone in the transition toward cleaner energy. However, the rapid growth of renewables presents numerous challenges:

- Grid Stability and Intermittency: Unlike traditional power sources, renewables are variable, requiring enhanced energy storage solutions and grid flexibility to ensure reliable power supply.

- Investment in Transmission Infrastructure: Many renewable energy projects are located in remote areas, necessitating substantial upgrades to transmission lines to connect them to population centers.

- Policy and Incentive Dependency: Federal and state incentives play a crucial role in sustaining renewable growth, but changes in political leadership or economic downturns could negatively impact future investments.

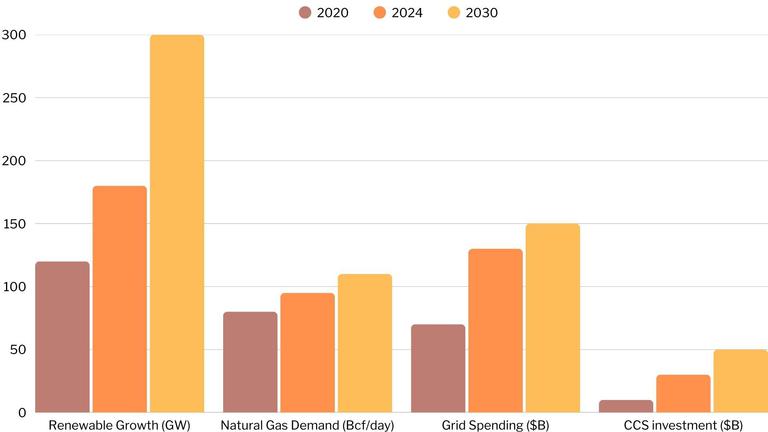

The following chart highlights the significant projected growth in renewable energy, natural gas demand, grid infrastructure spending, and increased investments in carbon capture and storage (CCS) as the industry transitions toward cleaner energy solutions.

The Role of Natural Gas in Energy Transition

Despite the push for renewables, natural gas remains a crucial component of the U.S. energy mix. U.S. natural gas consumption increased by 4% in 2024 due to growing power generation and industrial use. As demand for electricity grows due to increased AI computing, data centers, and electric vehicles, natural gas-fired power plants are playing a key role in balancing supply and demand. The implications include:

- Higher Gas Demand for Power Generation: Utilities are relying more on natural gas to provide baseload power and compensate for renewables’ intermittency.

- Price Volatility and Supply Chain Challenges: Natural gas markets are sensitive geopolitical events, extreme weather, and infrastructure constraints, which can lead to price fluctuations.

- Investment in Carbon Capture Technologies: To maintain its role in a low-carbon economy, the natural gas industry is increasing investments in carbon capture and storage (CCS) solutions to reduce emissions.

Regulatory and Policy Uncertainty

Federal and state policies continue to impact the energy sector’s trajectory. Recent executive orders limiting new offshore wind leases and increasing tariffs on energy-related imports introduce uncertainty for long-term planning. Key considerations include:

- Shifting Federal Energy Policies: Changes in administration can lead to reversals in energy policies, affecting project financing, permitting, and overall investment confidence.

- State-Level Disparities: While states like California and New York push aggressive renewable mandates, others remain focused on fossil fuel development, creating an inconsistent regulatory environment.

- Environmental Compliance Costs: Stricter emissions regulations on methane leaks and coal-fired plants are pushing energy companies to accelerate the transition to cleaner energy sources, impacting operating costs.

Grid Modernization and Infrastructure Investment

Aging energy infrastructure and growing electricity demand are driving efforts to modernize the U.S. grid. The shift toward a more resilient, flexible, and technology-driven grid will require the U.S. to invest $2.1 trillion in grid infrastructure by 2050 to support increased renewable integration and electrification. Factors for advancement include:

- Advanced Energy Storage: The expansion of lithium-ion and alternative battery technologies is critical for supporting renewable energy integration and reducing peak demand pressures.

- Smart Grid Technologies: Increased deployment of digital solutions, AI, and automation in grid management is helping utilities optimize energy distribution and reduce outages.

- Resilience Against Climate Change: More frequent extreme weather events are emphasizing the need for grid hardening investments, including underground transmission lines and storm-resistant substations.

Trade and Geopolitical Factors Influencing Energy Supply Chains

New tariffs and global supply chain disruptions are affecting the cost structure of energy projects. The energy industry is responding to these challenges through:

- Diversifying Supply Sources: Companies are seeking alternative suppliers for key components such as solar panels, wind turbines, and battery storage to avoid dependency on a single region.

- Onshoring and Domestic Manufacturing: Increased investment in U.S.-based manufacturing is helping mitigate supply chain disruptions and reduce reliance on foreign markets

- Geopolitical Risk Management: Energy firms are factoring in geopolitical tensions, including sanctions and trade restrictions, when making long-term investment decisions.

How Market Shifts Impact the Energy Industry

Investment Strategies

Energy companies must allocate capital efficiently to balance the shift toward renewables with the continued need for fossil fuel infrastructure. Key considerations include:

- Diversification of Energy Portfolios: Companies must invest strategically across various energy sources to mitigate risks associated with policy shifts and market volatility.

- Private and Public Financing Opportunities: Accessing capital through government incentives, institutional investors, and green bonds is critical for funding large-scale projects.

- Risk Management in Project Financing: Rising costs and regulatory uncertainties require more rigorous financial planning to ensure long-term viability.

Operational Adjustments

To maintain reliability and efficiency, grid operators and utilities must integrate new technologies and processes, such as:

- Upgrading Aging Infrastructure: Investments in modern transmission and distribution networks are necessary to accommodate the increasing share of renewable energy.

- Enhancing Grid Resilience: The use of AI-driven analytics, predictive maintenance, and

- automated demand response can improve grid stability and efficiency.

- Cybersecurity Measures: As the grid becomes more digitized, energy firms must prioritize robust cybersecurity frameworks to prevent cyberattacks and operational disruptions.

Regulatory Compliance

Staying ahead of policy changes is critical for optimizing permitting processes and avoiding legal and financial setbacks. This includes:

- Navigating Federal and State Policies: Companies must track and adapt to evolving regulations on emissions, carbon credits, and land use for energy development.

- Adopting Environmental, Social, and Governance (ESG) Standards: With increasing investor and consumer pressure, integrating ESG compliance into operations enhances credibility and access to funding.

- Streamlining Permitting and Approval Processes: Proactive engagement with regulators and policymakers can help expedite project approvals and reduce bureaucratic delays.

Supply Chain Resilience

Managing cost fluctuations and securing reliable supply chains will be key to sustaining long- term profitability. Companies must:

- Develop Localized Supply Chains: Investing in domestic manufacturing and alternative suppliers can reduce dependency on international markets.

- Adapt to Material Scarcity: Securing long-term contracts for critical materials such as lithium, cobalt, and rare earth elements is crucial to sustaining renewable energy expansion.

- Improve Logistics and Procurement Strategies: Utilizing AI and predictive analytics can optimize procurement, minimize costs, and ensure steady material availability.

How Chiron Financial LLC Supports the U.S. Energy Industry

Capital Raising

Chiron Financial assists energy companies in securing capital for new developments, infrastructure modernization, and acquisitions. Whether through private equity, institutional investors, or debt financing, Chiron helps clients access the funding they need to drive growth and meet their financial goals.Mergers & Acquisitions (M&A) Advisory

The evolving energy market presents numerous opportunities for consolidation and expansion. Chiron’s experienced advisors guide companies through complex M&A transactions, ensuring strategic alignment and maximizing value for stakeholders. With a focus on precision, creativity, and our clients’ long-term success, Chiron’s expertise ensures every deal strengthens our clients’ competitive position in the market.

Financial Advisory Services

From restructuring distressed assets to optimizing capital structures, Chiron provides tailored financial advisory services that support sustainable, long-term business success. We help companies navigate financial challenges with the goal of improving operational efficiency and maximizing value creation.Industry-Specific Expertise

Chiron’s deep knowledge of the energy sector allows us to deliver solutions that align with market realities, regulatory challenges, and growth opportunities. We understand the complexities of the energy landscape, and our leadership team — comprising seasoned professionals, including investment bankers with Wall Street experience, former private equity professionals, CEOs, and CFOs — brings unparalleled expertise to each engagement.

The U.S. energy industry is at a pivotal moment, shaped by rapid shifts in market dynamics, regulatory changes, and evolving consumer demands. Companies must proactively adapt to these trends to remain competitive and resilient.

Chiron Financial LLC stands as a trusted partner, offering capital raise solutions, strategic advisory services, and deep industry expertise to help energy businesses navigate uncertainty and capitalize on new opportunities. With a proactive approach and a commitment to innovation, Chiron is dedicated to empowering the U.S. energy industry’s future.

Citations:

- The Associated Press. “AI Boom Drives Higher Electricity Demand, Boosting Natural Gas.” AP News, 2024, https://apnews.com/article/6f9c2155ccb92c56f5f557f8308c241c. Accessed 18 Mar. 2025.

- Associated Press News. “A Breakdown of Major EPA Deregulatory Moves Around Water, Air, Climate.” AP News, 13 Mar. 2025, https://apnews.com/article/5fb7fc1d24f54f193d585643c8fba79f. Accessed 18 Mar. 2025.

- Chiron Financial LLC. Chiron Financial: Expert Financial Solutions for Energy and Other Industries. Chiron Financial, 2025, https://www.chironfinance.com. Accessed 18 Mar. 2025.

- Deloitte Insights. “2025 Renewable Energy Industry Outlook.” Deloitte, Dec. 2024, https://www2.deloitte.com/us/en/insights/industry/renewable-energy/renewable-energy-industry-outlook.html. Accessed 18 Mar. 2025.

- Global Relay. “Opinion: US Regulatory Compliance Outlook for 2025.” Global Relay, Jan. 2025, https://www.grip.globalrelay.com/my-us-regulatory-compliance-perspective-for-2025/. Accessed 18 Mar. 2025.

- Investor’s Business Daily. “Oil Prices, EVs, and the Future of Energy Demand.” Investor’s Business Daily, 2025, https://www.investors.com/news/oil-prices-trump-drill-baby-drill-evs-oil-stocks-demand. Accessed 18 Mar. 2025.

- Ivalua. “Top Supply Chain Management Strategies for 2025.” Ivalua, Jan. 2025, https://www.ivalua.com/blog/top-supply-chain-strategies-to-optimize-operations-in-2025/. Accessed 18 Mar. 2025.

- Prologis. “Building a Future-Proof Sustainability Strategy: A Guide for Supply Chain and Logistics Operations.” Prologis, 18 Mar. 2025, https://www.prologis.com/blog/building-future-proof-sustainability-strategy-guide-supply-chain-and-logistics-operations. Accessed 18 Mar. 2025.

- Reuters. “AI to Fuel Bumper Year for M&A in US Power Sector.” Reuters, 12 Mar. 2025, https://www.reuters.com/markets/deals/ceraweek-analysis-ai-fuel-bumper-year-ma-us-power-sector-2025 – 03-12/. Accessed 18 Mar. 2025.

- Reuters. “Chevron Advances Plans to Develop US Data Centers with Power Generation.” Reuters, 14 Mar. 2025, https://www.reuters.com/business/energy/ceraweek-chevron-advances-plans-develop-us-data-centers-with-power-generation-2025 – 03-14/. Accessed 18 Mar. 2025.

- Reuters. “Global Companies Eye More US Investment as Trump Touts Energy Dominance.” Reuters, 11 Mar. 2025, https://www.reuters.com/business/energy/ceraweek-global-companies-eye-more-us-investment-trump-touts-energy-dominance-2025 – 03-11/. Accessed 18 Mar. 2025.

- Reuters. “Key U.S. Energy Data Trends as Tariffs Take Effect.” Reuters, 5 Mar. 2025, https://www.reuters.com/business/energy/key-us-energy-data-trends-track-tariffs-kick-maguire-2025 – 03-05/. Accessed 18 Mar. 2025.

- Reuters. “Roaring US Solar Market Hit by Higher Import Costs.” Reuters, 5 Dec. 2024, https://www.reuters.com/business/energy/roaring-us-solar-market-hit-by-higher-import-costs-2024 – 12-05/. Accessed 18 Mar. 2025.

- Reuters. “US Grids Must Harness Electric Vehicle Growth to Tackle Load Risks.” Reuters, 18 Mar. 2025, https://www.reuters.com/business/energy/us-grids-must-harness-electric-vehicle-growth-tackle-load-risks-2025 – 03-18/. Accessed 18 Mar. 2025.

- The Wall Street Journal. “Wind and Solar Overtake Coal Power for the First Time in the U.S.” The Wall Street Journal, 2024, https://www.wsj.com/articles/wind-and-solar-overtake-coal-power-for-the-first-time-in-the-u-s-a52e9d8f. Accessed 18 Mar. 2025.

- United States Trade Representative. “USTR Publishes Policy Paper Series on Supply Chain Resilience.” Office of the United States Trade Representative, Jan. 2025, https://ustr.gov/about-us/policy-offices/press-office/press-releases/2025/january/ustr-publishes-policy-paper-series-supply-chain-resilience‑0. Accessed 18 Mar. 2025.

Meet Our Authors

Candice Hubert

Director, Business Development

Ms. Hubert is the Director of Business development with significant experience in the finance world.

Michael Miller

Managing Director

Mr. Miller brings over 30 years’ experience in investment banking, private equity and structured finance in multiple sectors, including energy and energy transition.