For lower and middle-market companies looking to raise money, it can be tempting to do it yourself. Maybe you have a few connections and can talk a good game. Problem is, running a company is a full-time job you already have. Distractions can weaken your position and devalue your business.

Another problem: contacting a handful of potential investors, lenders, or buyers will not get you the best deal available. Even riskier, your efforts may take much longer to conclude than you can afford. Suddenly, you’re in reactive mode, responding to problems instead of controlling your destiny. We’ve seen this movie many times.

Our investment banking team, which includes former CEOs and CFOs, understands these issues since some of us have lived, and learned from them. We take an informed yet realistic approach to learning everything we can about your company — from financial performance to your competitive landscape. We can address accounting and performance issues, determine whether you’re asking for enough capital, ultimately positioning your company for the best possible outcome.

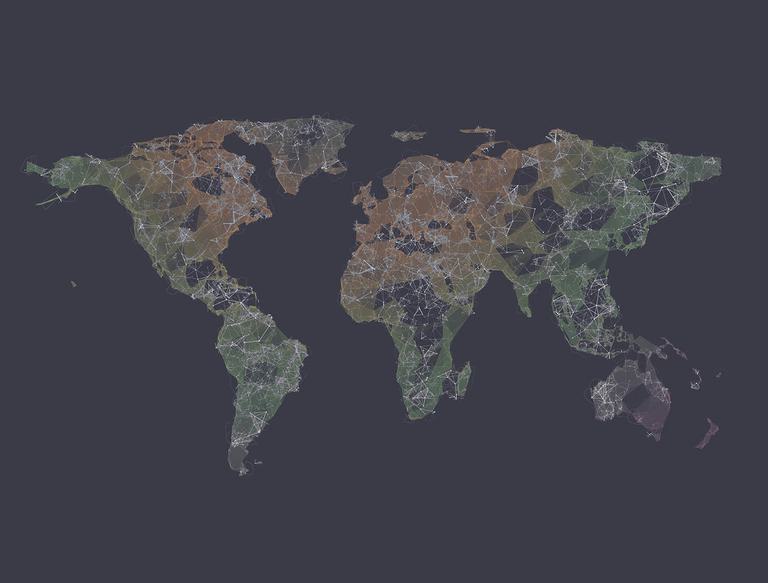

We then reach out — not to a handful but to hundreds of potential investors including credit funds, private equity firms, family offices, banks and other institutional investors. This maximizes your exposure, creating a situation where lenders are competing to invest in your company. At Chiron, raising capital is what we do. And we’ve perfected the process of doing it right.