Blogs

The Race to Decarbonize: How Chemical Companies Are Balancing Profitability and ESG Demands

As ESG imperatives reshape the industrial landscape, chemical companies in the U.S. and EU are racing to decarbonize — not just to comply, but to compete. Capital is flowing into green chemistry, while sustainability credentials are becoming critical to valuations, investor confidence, and M&A deal flow. This white paper examines how middle market chemical firms are navigating the transition, from technology adoption and capital allocation to regulatory strategy and deal positioning.

Decarbonization is no longer a distant mandate — it is a central force shaping how chemical companies operate, invest, and grow. As global climate goals accelerate, chemical producers face a dual challenge: reduce emissions while maintaining profitability and competitiveness.

In both the U.S. and the European Union (EU), chemical manufacturers are grappling with how to decarbonize capital-intensive processes without sacrificing operational stability or shareholder value. From feedstocks to finished goods, sustainability is reshaping value chains — and bringing new risks, costs, and opportunities to the forefront.

This article compares how U.S. and EU firms are addressing the decarbonization challenge, explores capital and technology trends, and provides strategic guidance for middle market stakeholders.

U.S. vs. EU: Two Paths Toward the Same Goal

The EU has taken a regulatory-first approach to decarbonization. Under the Green Deal and REACH expansions, even mid-sized chemical firms must disclose emissions, implement safer substances, and adopt low-carbon processes. Government incentives, such as the EU Innovation Fund, are helping support the transition.

The U.S. approach has been more market-driven — but it’s catching up. Investor expectations, downstream supply chain pressure, and SEC climate disclosure proposals are creating a compliance curve of their own. Federal funding under the Inflation Reduction Act (IRA) is now drawing capital toward green hydrogen, carbon capture, and electrification projects.

Chiron Insight: In the EU, decarbonization is regulatory survival. In the U.S., it’s becoming a competitive edge.

Capital Is Flowing Toward Green Chemistry

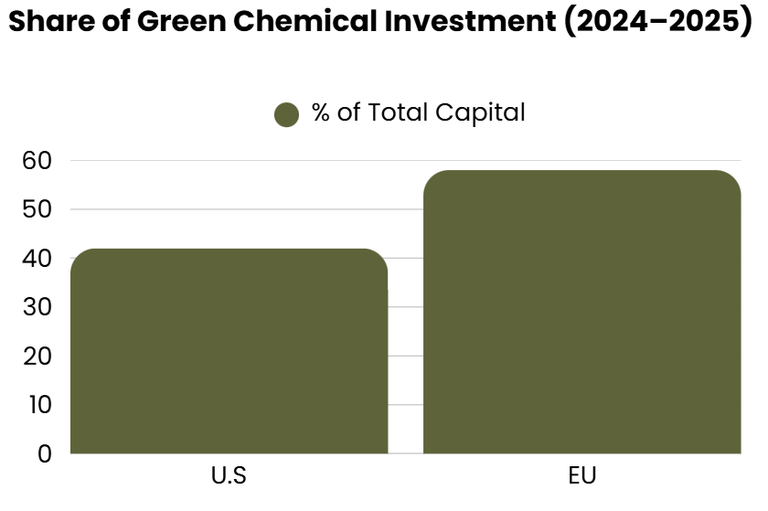

Whether incentivized by governments or markets, capital is moving rapidly into climate-forward segments. According to Chiron estimates and industry data:

EU producers are ahead in clean tech adoption, but U.S. players are beginning to close the gap through private equity and institutional capital channels.

Structural Challenges Facing Decarbonization

Recent investment reports from the European Chemical Industry Council (Cefic) and the U.S. Department of Energy suggest a steady acceleration in decarbonization-focused capital flows. These sources validate the relative positioning of the EU and U.S. markets presented above.

Despite capital and innovation trends, many chemical producers are encountering constraints in accessing low-carbon feedstocks at scale. Green hydrogen remains expensive, and infrastructure for electrification is inconsistent across geographies. These limitations challenge middle market operators to plan carefully — often requiring joint ventures, public-private partnerships, or vertical integration strategies.

Technology Trends: What’s Scaling, What’s Not

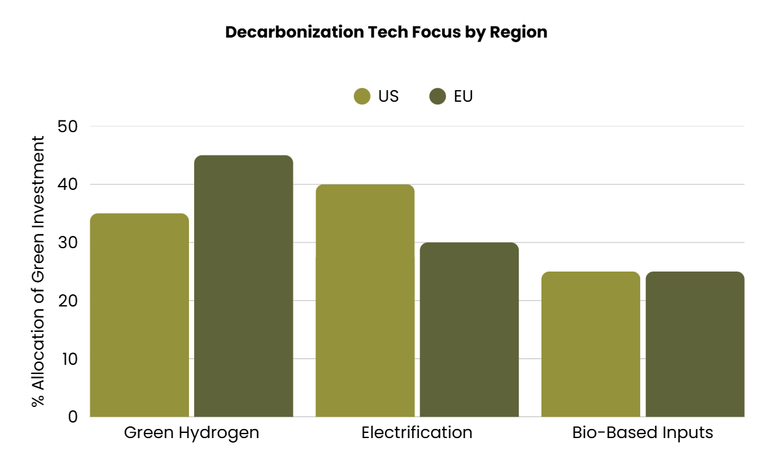

Green hydrogen and electrification are leading the way. In the EU, hydrogen projects are supported by public-private partnerships. In the U.S., industrial electrification — particularly in the Gulf Coast — is emerging as a scalable alternative to fossil-fueled heat.

Bio-based inputs and chemical recycling technologies are attracting attention across both regions, particularly in packaging and consumer end-markets.

M&A: Decarbonization as a Deal Catalyst

Environmental and sustainability attributes are now core elements of due diligence and valuation.

- Strategic acquirers are seeking cleaner product portfolios and energy-efficient infrastructure.

- Private equity is investing in low-carbon platforms to hedge against regulatory risk.

- Middle market sellers with proven ESG practices are commanding premium multiples.

What was once a “nice to have” has become a core driver of enterprise value.

How Chiron Financial Supports This Transition

With decades of experience advising industrial and chemical clients, Chiron Financial is uniquely positioned to help companies and investors navigate sustainability-linked transformation.

We offer:

- Capital raise support for decarbonization initiatives (growth, working capital, and project finance)

- Sell-side and buy-side advisory with ESG positioning

- Restructuring and recapitalization for firms facing regulatory or operational disruption

- Deep U.S. and EU experience across base, specialty, and green chemicals

The chemical industry is at a crossroads. Pressure to decarbonize will not ease — but the opportunity to lead remains. Companies that proactively align ESG goals with financial strategy will be best positioned to attract capital, partners, and premium valuations.

For middle market firms, the challenge is real — but so is the upside.

Chiron Financial stands ready to guide you through it.

Meet Our Authors

Michael Miller

Managing Director

Mr. Miller brings over 30 years’ experience in investment banking, private equity and structured finance in multiple sectors, including energy and energy transition.

Candice Hubert

Director, Business Development

Ms. Hubert is the Director of Business development with significant experience in the finance world.