Blogs

Manufacturing's Strategic Shift: How Value Creation and Smart Technologies Are Redefining Industrial Growth

As traditional cost-driven models become unsustainable, industrial manufacturers are embracing smart technologies, recurring revenue models, and strategic financial planning to drive future-ready growth. This white paper explores how innovation, services, and capital strategy are reshaping the path forward for mid-market industrials.

The manufacturing and industrial sectors are undergoing a profound transformation. Companies can no longer rely solely on cost minimization for competitive advantage. Instead, the path forward is through value creation, driven by innovation, smart technologies, sustainability, and resilient operations. This paper explores how manufacturers can capitalize on this evolution, the role financial strategies play, and the critical investments needed to build future-ready enterprises.

Why the Old Model No Longer Works

For decades, manufacturers have sought competitive advantage by reducing operational costs, optimizing supply chains, and outsourcing production to lower-cost regions. This cost-centric approach led to increased efficiency and scalability. However, recent global disruptions — including the COVID-19 pandemic, trade wars, climate-related disruptions, and geopolitical instability — have exposed fragility and risk embedded in these lean systems.

In today’s rapidly evolving industrial landscape, this legacy model no longer suffices. As Enno de Boer, Senior Partner at McKinsey & Company, notes: “To reap the real rewards of a digital transformation, a holistic approach is called for, one in which organizations transform by integrating technology and talent for optimum results” (World Economic Forum, 2024). This perspective underscores the need for manufacturers to go beyond incremental cost improvements and instead pursue integrated strategies that build resilience, adaptability, and long-term value.

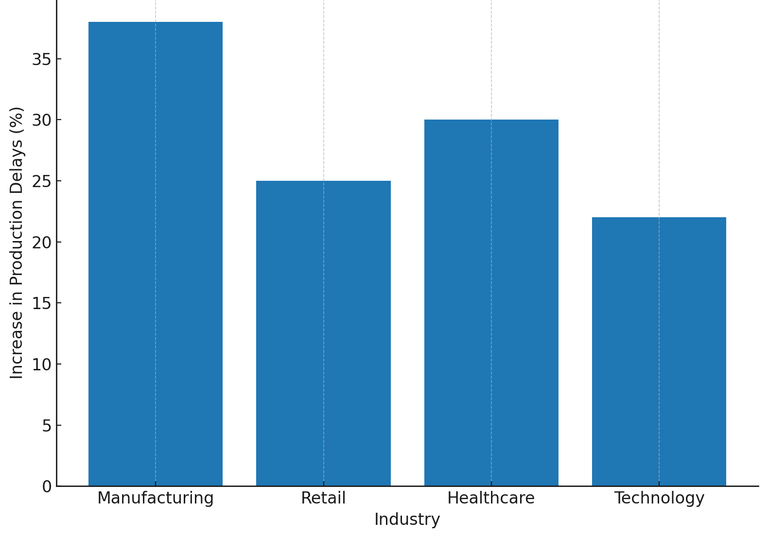

Key Challenges Facing Traditional Models:

- Supply chain vulnerabilities causing production delays and increased costs.

- Limited supplier diversification leading to bottlenecks and reduced flexibility.

- Customers demanding greater product customization, faster delivery, and higher service standards.

- Regulatory bodies tightening ESG (Environmental, Social, and Governance) compliance requirements.

Supply Chain Disruption Impact (2020−2023)

The New Industrial Playbook: Creating Value Beyond the Product

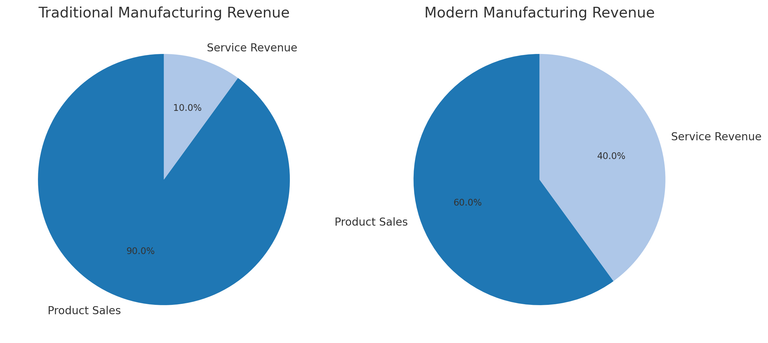

Traditional manufacturing models centered almost exclusively on the production and sale of physical goods. Success was measured by throughput, efficiency, and cost reduction. Once a product left the factory, the manufacturer’s role was largely complete.

In contrast, modern industrial strategies extend the manufacturer’s involvement across the entire lifecycle of the product, often tying customer value directly to ongoing services and outcomes rather than just a one-time sale. This holistic approach builds recurring revenue, enhances customer retention, and reduces cyclical risk.

New Business Model Strategies

- Product-as-a-Service (PaaS): Customers pay for outcomes rather than ownership, shifting revenue from one-time sales to continuous service fees.

- Value-added services: Remote monitoring, predictive maintenance, and operational consulting create recurring engagement and brand stickiness.

- Sustainability-first operations: Aligning operational excellence with environmental responsibility enhances brand value and regulatory compliance.

Business Benefits

- Capture recurring revenues that are more predictable and stable.

- Build deeper, more strategic customer relationships.

- Strengthen margins through service differentiation.

- Foster customer loyalty by delivering measurable client outcomes.

Revenue Contribution by Service Offerings (Traditional vs. New Models)

The Role of Smart Technologies

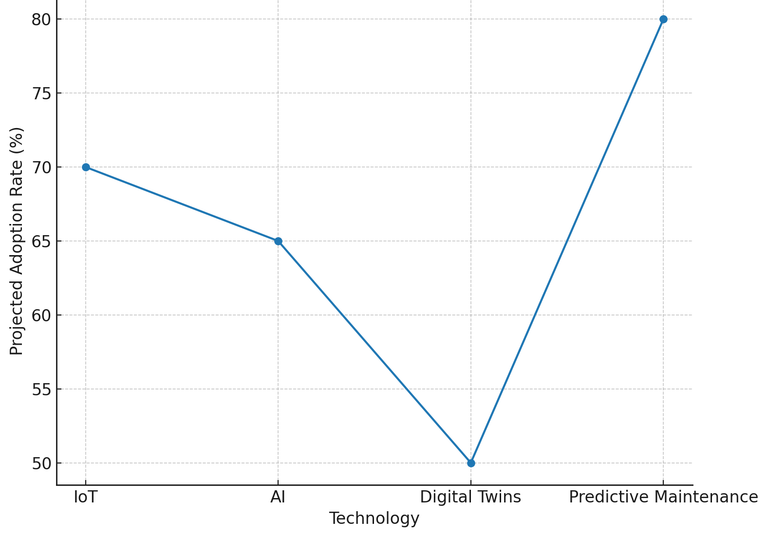

Smart technologies underpin the transformation by creating highly interconnected, data-driven, and adaptive manufacturing environments. Rather than simply improving existing processes, these technologies enable entirely new models of operation, agility, and customer engagement.

Real-Time Visibility with IoT (Internet of Things)

- The Internet of Things refers to the network of physical devices — such as machines, sensors, and equipment — that are embedded with software and connectivity to exchange real-time data. In manufacturing, IoT enables continuous monitoring of operations, which can significantly improve decision-making and operational performance.

Process Optimization through AI

- Machine learning models refine production, forecast maintenance needs, enhance quality control, and support autonomous decision-making.

Simulation with Digital Twins

- Digital twins are virtual models that mirror real-world assets, systems, or entire facilities. By creating a digital replica of a manufacturing process, companies can simulate operational scenarios, test design changes, and predict system behavior under varying conditions — without disrupting physical operations.

Downtime Prevention with Predictive Maintenance

- Predictive algorithms anticipate mechanical failures before they occur, leading to proactive interventions and reduced unplanned downtime.

Adoption Rates of Smart Technologies in Manufacturing (2020−2025 Projection)

Financing Innovation: Capital Strategies for the Next Era

Smart manufacturing requires significant upfront investment, presenting challenges for firms accustomed to cost-focused models. Traditional funding mechanisms may not be agile enough to support fast-paced innovation.

Strategic Capital Approaches

- Growth Capital: Enables timely investment in tech upgrades without over-leveraging core assets.

- Strategic M&A: Acquiring niche innovators to fast-track capability building.

- Debt Restructuring: Frees up cash for reinvestment while improving capital efficiency.

- Private Equity Partnerships: Introduce operational expertise and align capital with long-term innovation strategies.

At Chiron Financial, we help industrial companies align their capital structures with long-term innovation goals, ensuring they are prepared to seize opportunities while maintaining financial resilience.

The ESG Imperative: Sustainability as a Strategic Lever

Manufacturers today must integrate sustainability into their core strategy, not only to meet compliance but to secure investor confidence and long-term viability.

ESG and Capital Access

- Companies with strong ESG practices are more likely to attract favorable financing terms and investor interest.

- Sustainability-linked loans and green bonds are emerging as key capital vehicles.

Beyond Compliance

- ESG-aligned companies outperform in brand trust, customer loyalty, and innovation potential.

Challenges to Overcome

While the opportunities are significant, companies must address several hurdles:

Operational and Cultural Barriers

- Capital Intensity: High upfront costs with longer payback periods.

- Legacy Systems Integration: Difficulty connecting old infrastructure with new technologies.

- Workforce Transformation: Urgent need to upskill teams for digital environments.

- Cybersecurity: Increased risk exposure as connectivity scales.

- Change Resistance: Shifting culture toward innovation requires leadership and training.

Proactive investment planning, phased digital adoption, and robust change management strategies are critical to overcoming these barriers.

Building a Resilient, Future-Ready Industrial Enterprise

Manufacturers who embrace value creation, leverage smart technologies, integrate ESG strategies, and align their financial structures with transformation goals will lead the next industrial revolution.

Strategic Recommendations:

- Evaluate your revenue mix for potential service-based growth.

- Prioritize 1 – 2 smart technologies that align with measurable ROI.

- Assess and restructure capital to support innovation without compromising resilience.

- Integrate ESG frameworks into financial planning to increase access to sustainability-focused capital.

At Chiron Financial, we are committed to guiding industrial firms through this pivotal evolution, ensuring strategic growth, operational resilience, and enduring market leadership.

Meet Our Author

Candice Hubert

Director, Business Development

Ms. Hubert is the Director of Business development with significant experience in the finance world.