Blogs

Family Offices and Chiron Financial: What Brings Us Together?

Chiron Financial LLC has released a white paper on the evolving role of family offices in wealth management. As ultra-high-net-worth individuals seek flexible strategies, family offices are expanding into private equity, real estate, and venture capital. This paper explores their growth, rising regulatory scrutiny, and need for specialized expertise. Chiron Financial helps family offices navigate complex investments, raise capital, and unlock exclusive opportunities.

The Rise of Family Offices in a Changing Global Landscape

Family offices have become a central part of modern wealth management, experiencing rapid growth as ultra-high-net-worth individuals (UHNWIs) seek personalized, flexible, and long-term investment solutions. Once focused solely on preserving wealth for future generations, family offices are now expanding into alternative investments like private equity, real estate, venture capital, and more. This growth is driven by rising global wealth, with family offices now controlling trillions in assets.

This paper explores the growing role of family offices and how Chiron Financial partners with them to navigate complex investment landscapes, raise capital, and access exclusive opportunities.

Understanding Family Offices: Growth and Opportunity

What is a Family Office?

Family offices are private wealth management firms created to manage the assets of UHNWIs. They focus on both liquid and non-liquid assets, utilizing professional investment teams to deploy capital across a diverse range of sectors. For this paper, we focus on family offices managing at least $100 million in assets, with dedicated teams for investment strategy and operations.

Explosive Growth and Expansion

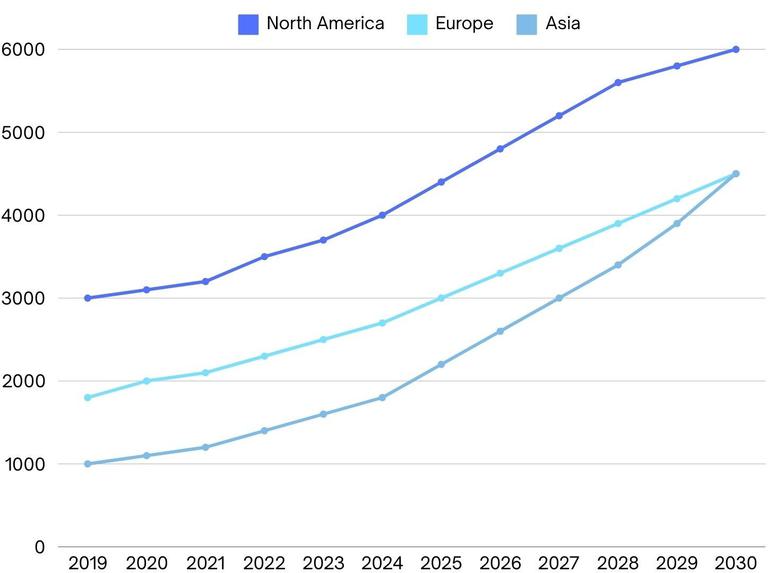

Family offices have seen remarkable growth. According to Deloitte, the number of family offices has increased by 31% from 2019 to 2024, with projections suggesting a 75% growth by 2030. Family offices now control over $3 trillion in assets, a figure expected to rise to $5.4 trillion by 2030.

Growth of Family Offices by Region (2019−2030) Actual and Projected Trends

- 8,000 single-family offices globally as of 2024 (Deloitte).

- $3.1 trillion in assets under management (AUM), projected to reach $5.4 trillion by 2030.

- 31% growth in family offices from 2019 to 2024.

- 68% of family offices were established since 2000, highlighting new wealth generation.

The Global Influence of Family Offices

Regional Distribution

Family offices are flourishing in North America, Asia Pacific, and Europe. As of 2024, North America leads with 3,180 family offices, followed by Asia Pacific (2,290) and Europe (2,020). In Switzerland alone, over 250 single-family offices manage nearly 600 billion Swiss francs.

Diversification Beyond Traditional Assets

Family offices are increasingly diversifying their portfolios beyond traditional investments. The rise in new wealth generation, particularly in emerging markets, has pushed family offices to seek more innovative, higher-yielding investments such as private equity and venture capital.

The Confidential and Relationship-Driven Nature of Family Offices

Discretion and Trust

Family offices are known for their discretion and selectiveness. They operate largely through personal connections and trusted referrals, often avoiding direct outreach from unfamiliar parties. Trust and confidentiality are paramount in all dealings.

Chiron’s Trusted Expertise

Chiron Financial has built long-term relationships with family offices, providing customized solutions while respecting the need for privacy and confidentiality. We deliver value through a network of trusted partners, ensuring that all engagements are handled with the highest level of professionalism.

Regulatory Landscape for Family Offices

Regulatory Scrutiny on Family Offices

- Family offices operate in a relatively unregulated environment compared to traditional financial institutions. However, as their role in the financial ecosystem grows, there is increasing scrutiny, especially regarding anti-money laundering (AML), tax reporting, and cross-border investments.

Navigating Complex Regulations

- Chiron Financial ensures that all transactions comply with relevant regulations, offering transparency while protecting family offices from potential legal and financial risks. We navigate the complexities of international regulations to safeguard family offices in an evolving financial landscape.

Regulatory Scrutiny on Family Offices

- Family offices have traditionally operated with limited regulatory oversight, but increasing global scrutiny is reshaping their compliance landscape, particularly in Anti-Money Laundering (AML), tax reporting, and cross-border investments.

Dodd-Frank Act & Family Office Rule

- The U.S. Securities and Exchange Commission (SEC) exempts single-family offices from investment adviser registration under the Investment Advisers Act of 1940, but broader financial regulations, including anti-fraud and transparency measures, still apply.

Corporate Transparency Act (CTA)

- Requires disclosure of beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN) to combat illicit financial activities. However, legal challenges have delayed enforcement.

Anti-Money Laundering (AML) Enforcement

- A recent conviction of a Miami real estate broker for laundering funds for Russian oligarchs highlights stricter enforcement efforts, particularly targeting high-value transactions and politically exposed persons.

International Compliance

- The Organization for Economic Co-operation and Development (OECD)’s Common Reporting Standard (CRS), the European Union’s Anti-Money Laundering Directives (AMLD), and China’s Foreign Investment Law are imposing increasing obligations on cross-border family office operations, requiring enhanced transparency and due diligence.

As global regulatory scrutiny intensifies, family offices must proactively strengthen their compliance frameworks to address these evolving risks.

The Need for External Expertise: Consultants and Advisors

External Support

While family offices often rely on a small, lean internal team, they frequently engage external consultants for specialized advice. These include tax advisors, legal experts, and financial consultants who offer tailored solutions for both liquid and non-liquid assets.

Chiron’s Specialized Role

Chiron Financial specializes in non-liquid asset management, focusing on complex business ventures and direct investments. We leverage our extensive network of partners — ranging from lawyers and tax specialists to private equity firms — to help family offices manage their unique wealth challenges.

Chiron Financial’s Role in Supporting Family Offices

Chiron Financial collaborates with family offices to unlock unique investment opportunities and provide expert advisory services tailored to their complex needs. Here’s how we work with family offices:

Capital Raising

Family offices often require external support when raising capital for large ventures or projects. Chiron Financial assists with:

- Structuring capital raises to optimize funding strategies.

- Providing access to institutional investors, venture capital, and private equity sources.

- Expertise in equity offerings, debt issuance, and other fundraising methods.

Mergers & Acquisitions (M&A) Advisory

Many family offices invest in or hold stakes in private companies. Chiron Financial supports family offices throughout the M&A process by:

- Identifying potential acquisition targets or buyers.

- Valuing businesses and assets for fair pricing.

- Negotiating and managing transactions to protect the family office’s interests.

Private Placements & Direct Investments

Many family offices invest in or hold stakes in private companies. Chiron Financial supports family offices throughout the M&A process by:

- Access to exclusive private placement opportunities.

- Support with due diligence to ensure transparency and mitigate risk.

- Tailored investment opportunities not available on the broader market.

The Future of Family Offices and Chiron Financials’ Role

As family offices continue to grow and evolve, they face increasingly complex financial landscapes. Chiron Financial is uniquely positioned to support family offices with capital raising, M&A advisory, and direct investment opportunities. Our expertise in structuring deals, facilitating due diligence, and accessing exclusive opportunities ensures that family offices can achieve their financial objectives.

In addition to supporting family offices directly, we provide strategic financial advisory services to their portfolio companies — whether for growth initiatives, refinancing, restructuring, or facilitating successful exits through M&A.

With a deep understanding of the family office sector, a vast network of trusted partners, and a commitment to confidentiality and ethical standards, Chiron Financial is the ideal partner to navigate the future of wealth management. To explore how Chiron Financial can raise capital, assist your family office with tailored investment strategies, and unlock exclusive opportunities, contact us today for a personalized consultation.

Meet Our Author

Greg Bouille

MD & Head of EMEA Region

Mr. Bouille is a trusted advisor for Chiron with over 25 years of experience in building, transforming, and developing global businesses, such as family-owned businesses, private equity-backed firms, SMBs and international corporations.